Eltek Ltd.: A Company Poised and Ready to Take Advantage of the Global Supply Chain Shift

Note: Originally published on SeekingAlpha.com on March 10, 2020

Summary

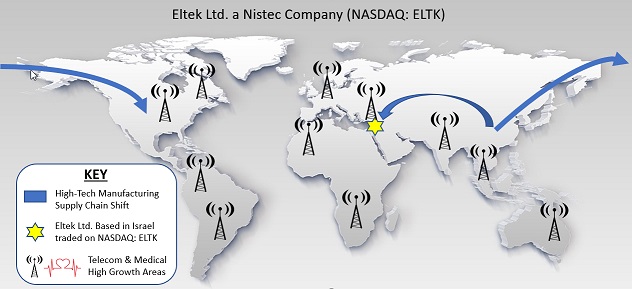

- ELTK, based in Israel, is a worldwide leading technology company focused on the manufacturing of highly complex Printed Circuit Boards (PCBs), having medical, 5G Telecom, defense, and other industrial applications.

- Following three consecutive quarters of GAAP profit and a successful phase 1 turnaround plan, with the latest 3rd quarter earnings of $0.08 EPS, ELTK is highly undervalued based on fundamentals.

- The US-China trade war, supply chain shifts, and Coronavirus outbreak impacts are likely catalysts for ELTK’s growth as the Company provides geographical diversity advantages, and Israel is a strategic U.S. partner.

- ELTK has a recent history of being shareholder-friendly by offering unique investment opportunities to shareholders while growing share value.

- I detail my bullish stance and prescience of a bright future for ELTK, and the current undervaluation ascribed to ELTK given fundamental business analysis.

Introduction

(Disclosure: I am a 5%+ shareholder of ELTK and an Activist Investor in the Company. All statements not sourced are my opinion only. A full disclosure statement appears at the end of this article.)

Eltek Ltd. (NASDAQ: ELTK) is a high-end global supplier and manufacturer of sophisticated and highly advanced Printed Circuit Boards (PCBs) based in Petah Tikva, Israel. Following Phase 1 of a turnaround plan, the Company delivered an operating profit as well as a net profit for three consecutive quarters. ELTK is a premiere leader in PCBs, in business for 50 years, and its customers include leading companies in the defense, aerospace, and medical industries in Israel, the United States, Europe, and Asia. Additionally, ELTK is benefited from ownership and control by Nistec, a much larger organization.

“The Company is controlled by Nistec Golan Ltd (“Nistec Golan”). Nistec Golan is controlled indirectly by Mr. Yitzhak Nissan.”

Source: https://www.sec.gov/Archives/edgar/data/1024672/000117891319002442/exhibit_99-2.htm

Getting to Know ELTK

Understanding the Growing High-End PCB Market

The general PCB industry’s expected to grow to “$89.7 billion by 2024 with a CAGR of 4.3% from 2019 to 2024.”

Within this growing PCB market, the high-end Flexible Printed Circuit Boards, “market size expected growth is 11.2% CAGR through 2025.” ELTK is a Recognized Worldwide Leader in this high-end growing tech niche and I believe ELTK will benefit through continued revenue and profit growth.

“The ongoing trend of miniaturization and development of multi-feature electronic devices is pushing PCB manufacturers to produce highly dense and high-speed flexible PCBs. The market is highly consolidated with the top five manufacturers accounting for a major share and generally determining the overall trend. Key players operating in the global market include” Eltek Ltd and others.

Source: Printed Electronics NOW https://bit.ly/2T2h21Y

Thomasnet.com lists ELTK as number 4 of the Top Global PCB Manufacturing Companies.

Source: https://www.thomasnet.com/articles/top-suppliers/pcb-manufacturers-suppliers/

Phase 1 Turnaround – How ELTK Became Profitable

Increased margins through a mix of product churning and better order fulfillment selection, in addition to management of their expenses for cash flow, made ELTK profitable. These changes were not short-term cuts at the expense of long-term growth. ELTK continued to maintain GAAP profitability during in both Q2 and Q3 while growing revenue to the highest in years in Q3 and all the while increasing margins.

CEO Eli Yaffe stated during Q1 2019 earnings call:

“We are glad that this quarter results reflect the first stage of our turnaround plan, which we started during the last quarter of 2018. We identified the products that were underpriced and have declined such orders in order to increase profitability. We’re also closely monitoring our personnel expenses with a focus on cash flow.”

“Our revenue in the first quarter of 2019 was $8.7 million as compared to revenue of $8.9 million in the first quarter of 2018.”

For Q1 2019, ELTK delivered $242,000 net profit, providing net cash from operating activities of $1.6 million compared to net cash used of $859,000 during the first quarter of 2018.

Source: https://www.sec.gov/Archives/edgar/data/1024672/000117891319001603/exhibit_99-1.htm

Long Term Contracts

Company Press Release, January 9, 2020.

Source: https://www.sec.gov/Archives/edgar/data/1024672/000117891320000075/exhibit_99-1.htm

Eltek Ltd. Received an Additional Order for Up To $1.4 Million From a Governmental Authority

In addition, to enable the execution of the project, the customer shall lend the Company, for no consideration, equipment in a total value of approximately $630,000.

CEO Eli Yaffe, commented: “The original selection of Eltek by this customer attests to the trust in the Company’s technological capabilities.”

US-China Trade-War, Supply Chain Shift, Coronavirus

Companies are in the process of diversifying and shifting their supply chains out of sole reliance on China. The trade war and now the coronavirus accelerated this supply chain shift.

“Coronavirus Could Be the End of China as A Global Manufacturing Hub”

Source: Forbes

I believe ELTK and Nistec are in a leading position to benefit from the global supply chain shift.

Many companies, including the largest in the world, are having difficulties locating alternative manufacturing centers. Vietnam and Thailand are two alternative locations sometimes mentioned; however, I believe Israel is another potential beneficiary.

Two news articles supporting and detailing the desires and challenges in shifting the manufacturing supply chain are:

“Apple, Microsoft, Google look to move production away from China. That’s not going to be easy.”

“Tesla delivered cars to customers in China with lower-performance Autopilot hardware than promised. Tesla blamed its decision to use the older version of their hardware in new Model 3s on supply chain disruptions.”

Backwinds from Macro-environment

During the 2019 Q2 conference call, CEO Eli Yaffe said, “The macro-environment and tariffs in the U.S. market for the products imported from China may provide a positive backwind for the segment of military product that Eltek produces.”

Note: My name is spelled wrong in the earnings call transcript.

I asked for further clarification about the backwind, Eli answered, “What I meant when I speak about backwind is tariff that was changed in United States mainly for import from China for military products, not for mobile. And since we are partners and players in the defense market, it’s a backwind for us.”

During the Q3 call CEO Eli Yaffee again mentioned backwinds:

“We are glad that this quarter results continue to reflect the implementation of our previously announced turnaround plans. Even so, it is still not reflected in our revenue; the macro-environment enters in the U.S product imported from China may provide positive backwind for the segment of the military products that Eltek produce. The increase in our total line reflects a continued market recognition of our high quality and reliable products.”

ELTK is a Special Microcap Company

50 Year History and Support from Nistec

Founded in Israel in 1970, ELTK’s survived and competed at a world-class level for 70 years. I don’t know any other micro-caps that can make this claim. Additionally, Nistec Golan provides strong financial backing along with additional sales channels and stronger purchasing power for raw materials.

RELATED PARTY BALANCES AND TRANSACTIONS

“Soldering and assembly services – The Company may acquire soldering services and/or purchasing services from Nistec.”

“Insurance expenditures – The Company may share with Nistec costs of insurance consulting and insurance premiums.”

“Employees social activities – The Company may purchase social activities for the benefit of its employees together with Nistec.”

“Marketing activities – The Company may purchase services together with Nistec. “

Source: https://www.sec.gov/Archives/edgar/data/1024672/000117891319002442/exhibit_99-2.htm

History of Shareholder Friendly Benefits

Early in 2019 ELTK, was trading around in the mid-$1 range after losing money for several years, going through a 5 to 1 reverse stock split, and needing recapitalization. ELTK’s Board and the executive team chose to offer existing shareholder subscription rights whose terms and conditions were generous and favorable, not to a Wall Street investment firm, but instead to mom-and-pop investors. Investors in ELTK had a first chance opportunity to participate in the recapitalization. Unlike typical micro-cap companies that continue issuing new shares and diluting to raise capital, this was the first time ELTK ever issued additional shares under Nistec Golan Ltd. ownership.

Details of the Subscription Rights: “We will distribute to you five (5) subscription rights for every three (3) ordinary shares that you own on the record date. Your rights will be rounded down to the nearest whole number and accordingly, no fractional rights will be issued in the rights offering. Each right entitles the holder to purchase, at a price of $1.464 per share, one ordinary share.”

Source: https://www.sec.gov/Archives/edgar/data/1024672/000117891319000852/zk1922817.htm

Shareholders who purchased these rights potentially made up to about 5x profit when the Company turned profitable in 2019 Q1.

Financial Metrics

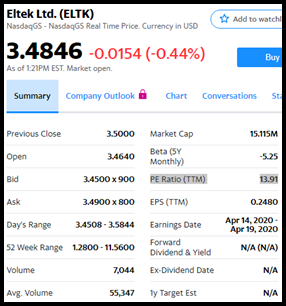

PE Ratio: Sometimes, PE is a simple, easy way to value a company; however, it does not apply in every situation, and I believe it is misleading when looking at ELTK. For example, finance.yahoo.com currently shows the PE ratio of ELTK at about 13.91.

Source: Yahoo Finance (March 3, 2020)

However, this PE ratio states it is TTM (Trailing Twelve Months). In the case of ELTK, they did not become profitable until Q1 2019; hence data before the company turnaround is likely negatively impacting the PE ratio and other financial metrics. I believe it’s a mistake to use those metrics for value decision-making without understanding the details. If ELTK continues to maintain profitability for a 4th consecutive quarter, assuming all else is equal, then the PE should be lower.

Other statistics, such as a 52-week range, EPS (TTM), will likewise only be updated to relevant post-turn-around metrics sometime after the 2019 Q4 earnings release.

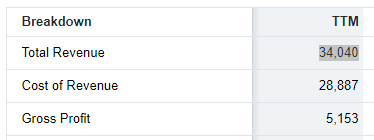

Price-To-Sales Ratio:

Calculated by using Mkt cap / Total revenue over the past 12 months

Using the Market Cap of $15.115M as of March 3, 2020, and a TTM Revenue of $34.040M, the most recent price-to-sales ratio is a mere 0.44 indicating the Company is severely undervalued. A 0.44 price-to-sales ratio is low for a growth-oriented company in an industry undergoing expansion and favorable macro-economic factors moving into the future.

Source: https://finance.yahoo.com/quote/ELTK/financials?p=ELTK

Historical Background

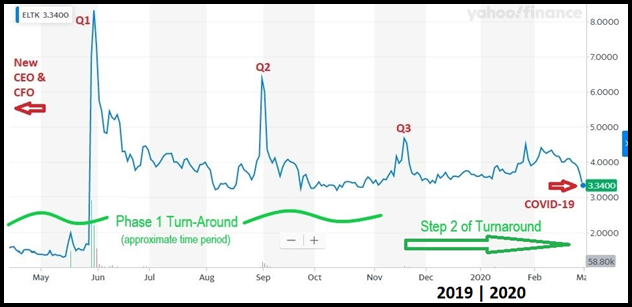

A Brief Explanation of the Past 1 Year Stock Chart:

Source: https://finance.yahoo.com/quote/ELTK/chart?p=ELTK

Analysis and Annotation: Author’s

In 2018, ELTK was losing money. A new CEO Eli Yaffe, and CFO Alon Mualem, took over to make the changes needed to make ELTK profitable.

The new executive team put together and executed a successful phase 1 of a turnaround plan detailed below. Since becoming profitable in Q1 2019, ELTK’s continued maintaining its GAAP profitability for all subsequent quarters.

Q1 Price Spike – GAAP Profitable

The market was shocked by the profitability news, and the stock soared 550% in two days. Given the exuberant reaction from the report and the known fundamentals at that time, it is not surprising that the stock had a bit of a pullback. However, the turnaround was real.

“Chief Executive Officer Eli Yaffe said that the Company was delighted that the results are a reflection of the first stage of the implementation of its turnaround plan that commenced in Q4 2018. He added that the Company continues with its effort of enhancing operating efficiencies, improving customer experience, formulating effective sales strategies as well as its continued implementation of the plan to achieve sustained profitability.”

Source: https://smallcapexclusive.com/eltek-ltd-nasdaq-eltk-stock-soars-550-in-2-days-whats-the-buzz/

Diagnosing More Recent Trading and Volatility (Q2, Q3, and COVID-19)

Q2 2019 Price Spike

Momentum traders piled into ELTK before the Q2 earnings release in anticipation of an excellent report and given the previous price spike ELTK exhibited following Q1 earnings. For Q2 net cash provided by operating activities was $1.3 million, and ELTK had a $7,000 operating profit as compared to an operating loss of $721,000 in the second quarter of 2018. However, while ELTK was profitable, most of the earnings came from an insurance payment on broken equipment required for manufacturing operations. “Other Income was $871,000 in the second quarter of 2019, mainly attributable to receipt of payment on an insurance claim made.”

Source: https://www.sec.gov/Archives/edgar/data/1024672/000117891319002308/exhibit_99-1.htm

Following the Q2 earnings report, ELTK went back to trading in the mid-three-dollar range.

Q3 2019 Price Spike

ELTK delivered its best quarter in years.

“As Eli mentioned, revenues for the third quarter of 2019 increased to $9.3 million, compared to revenues of $8.5 million during the third quarter of 2018. Gross profit increased from $973,000 or 11.4% of revenues in the third quarter of 2018 to $1.8 million or 18.9% of revenues in the third quarter of 2019.

During the third quarter, we had an operating profit of $568,000 as compared to an operating loss of $307,000 in the third quarter of last year. Net profit was $391,000 or $0.09 per fully diluted share compared to a net loss of $463,000 or $0.23 per fully diluted share in the same quarter last year.”

Traders drove the shares of ELTK up to a high of $5.55 two days before the earnings release. Many people perceiving a downward series of spikes based upon Q1 and Q2, set their trading strategy to sell the stock before earnings. Examining the trading around the Q3 earnings release in the table below shows this activity. ELTK stock initially spiked on November 15th and 18th; however, the high of $5.55 was lower than the spike, which occurred before Q2 earnings. ELTK then started to sell off on November 19, the day before earnings on November 20. By the close of trading on December 20, the day of earnings, ELTK was down to $3.96 per share.

ELTK Historical Price Table Q3 Earnings

| Day | Fri | Mon | Tue | Wed | Thu |

| Date | 15-Nov-19 | 18-Nov-19 | 19-Nov-19 | 20-Nov-19 | 21-Nov-19 |

| Open | 3.88 | 4.18 | 4.82 | 5.03 | 3.82 |

| High | 4.12 | 5.55 | 5.03 | 5.2 | 3.89 |

| Low | 3.73 | 4.16 | 4.33 | 3.52 | 3.62 |

| Close* | 4.06 | 4.68 | 4.54 | 3.96 | 3.69 |

| Volume | 45,900 | 1,186,700 | 364,900 | 727,000 | 171,100 |

| Comments | Start of Price Runup | High Price 2 Days before earnings | 1 Day Before Earnings First Selloff | Earnings Release Selloff | Back to Trading in the $3 Range |

Data Source: https://finance.yahoo.com/quote/ELTK/history?p=ELTK

Why the Selloff After Q3 Earnings?

I believe, going into the Q3 earnings release, momentum traders, including short traders, were counting on the stock to go up before the earnings release and go down on a “sell-the-news” mentality as per the trend of the prior two quarters. To the shorts’ surprise, the Q3 earnings were ELTK’s best in years. Caught on the wrong side, and facing initial upward momentum from the earnings report, shorts ensued to devalue the stock in the premarket and early trading to rattle the short-term momentum traders looking for a sudden rise in the price. The shorts succeeded in shaking out the upward momentum players and changing the momentum of the stock towards a downtrend.

Looking at the short interest report information in the table below, we can see how shorts contributed to the share price fall following Q3 earnings. The short interest in ELTK spiked to an all-time high of 142,662 shares on 12/13/2019. The only previous time ELTK had such a substantial short interest was after the exuberant spike in ELTK stock to $11.56 per share following Q1 earnings.

Short Interest Table

| SETTLEMENT DATE | SHORT INTEREST | % Change | COMMENTS |

| 5/15/2019 | 590 | -85.56% | |

| 5/31/2019 | 128,020 | 21598.31 | After Q1 Eltek Popped to $11.56 per share on 11/5/2019 |

| 6/14/2019 | 66,727 | -47.88 | |

| 6/28/2019 | 87,109 | 30.55 | |

| 7/15/2019 | 52,974 | -39.19 | |

| 7/31/2019 | 46,769 | -11.71 | |

| 8/15/2019 | 41,498 | -11.27 | |

| 8/30/2019 | 60,871 | 46.68 | |

| 9/13/2019 | 80,490 | 32.23 | |

| 9/30/2019 | 31,101 | -61.36 | |

| 10/15/2019 | 31,300 | 0.64 | |

| 10/31/2019 | 27,453 | -12.29 | |

| 11/20/2019 | Q3 Earnings Report | ||

| 11/15/2019 | 44,309 | 61.4 | |

| 11/29/2019 | 135,734 | 206.34 | First Short Interest Report Following Q3 Earnings |

| 12/13/2019 | 142,662 | 5.1 | The all-time highest number of short shares |

| 12/31/2019 | 115,302 | -19.18 | |

| 1/15/2020 | 123,431 | 7.05 | Shorts increased after a great news release of government contracts. |

| 1/31/2020 | 20,906 | -83.06 | |

| 2/14/2020 | 15,681 | -24.99 | |

| 2/28/2020 | ? | ? | Next dissemination date of short interest (3/10/2020) |

Data Source: https://www.nasdaq.com/market-activity/stocks/eltk/short-interest

COVID-19 – Coronavirus Impact to Stock Price

Most recently, ELTK stock price fell with the general market coronavirus fears. The stock went from the low $4 range to a low of $3.23 on Friday, February 28. However, this fall in stock price occurred on low single-digit % outstanding share volume. See Coronavirus Table below.

Coronavirus Table

| Day | Tuesday | Wednesday | Thursday | Friday | Monday |

| Date | 25-Feb-20 | 26-Feb-20 | 27-Feb-20 | 28-Feb-20 | 2-Mar-20 |

| Open | 4.06 | 3.89 | 3.89 | 3.51 | 3.53 |

| High | 4.06 | 3.94 | 3.89 | 3.52 | 3.64 |

| Low | 3.86 | 3.82 | 3.66 | 3.23 | 3.36 |

| Close* | 3.96 | 3.88 | 3.66 | 3.34 | 3.5 |

| Volume | 21,100 | 27,700 | 40,300 | 58,800 | 15,200 |

| % of Outstanding Shares Traded | 1.64% | 2.15% | 3.13% | 4.56% | 1.18% |

Rebutting a Potential Short Argument of Additional Shares

Shorts traders may try to make the following false argument: “ELTK filed a registration for additional securities and ELTK stock will collapse upon issuance of $10 million of securities that are 60% of their market cap.”

My research shows this case is unlikely based on constraints within the F-3, specifically preventing any significant dilution.

Those constraints in the SEC F-3 filing state:

“The aggregate maximum offering price of all securities covered by this Registration Statement will not exceed $10,000,000.”

“In no event will we sell securities pursuant to this prospectus with a value of more than one-third of the aggregate market value of our Ordinary Shares held by non-affiliates in any 12-month period, so long as the aggregate market value of our Ordinary Shares held by non-affiliates is less than $75,000,000.”

The aggregate market value of “outstanding Ordinary Shares held by non-affiliates on August 7, 2019”, “was approximately $4.9 million.”

Based on the above, if ELTK had issued securities on August 7, 2019, then the maximum value would have been $1.6 million, or 10.6% of its market cap at that time.

Example Calculation: One-third of $4.9 million is approximately $1.6 million. ELTK traded at a high of $3.41 on August 7, 2019, with a market cap of roughly $15 million (slightly lower than today’s market cap). Given this, $1.6 million is 10.6% of $15 million.

Additionally, as of this time:

The registration filing was on 2019-08-08. It is now March 2020, 7 months after the initial registration, and there is no issuance of additional securities.

CFO Alon Mualem, during the Q3 earnings call, described the filing as a baby shelf prospectus “to provide the company the ability to raise funds, if market condition[s] will support such fundraising.”

Q3 Earnings Call Source: https://seekingalpha.com/article/4308028-eltek-ltd-eltk-ceo-eli-yaffe-on-q3-2019-results-earnings-call-transcript

Lastly, an assumptive question on the Q3 earnings call asked about “future potential offerings to raise capital for the company to continue operations.” CFO Alon Mualem responded it was to “provide the company the ability to raise funds if market condition[s] will support such fundraising.” Subsequently, when asked if, from a cash flow perspective, ELTK is in “financially stable condition leading into 2020 at this point?” CEO Eli Yaffe stated, “Our current cash flow is positive.”

ELTK does not need the money “to continue operations,” if they were in such dire need of cash for operations, they would have issued the securities by now. Speculative productive uses of the potential funds are growth initiatives or paying down debt to shore up the balance sheet. CEO Eli Yaffe said, “we’re all focused on expanding our business.”

For all these reasons, I view the SEC F3 Registration filing for possible additional securities as favorable and within the interest of shareholders.

Why I Invested in ELTK

The market has not yet recognized ELTK as a profitable and robust global leader in the fast-growing high-end PCB manufacturing space and a potential beneficiary of the worldwide supply chain shift.

I believe ELTK is significantly undervalued. Neither the current fundamental value nor the significant longer-term growth potential is recognized yet. Potential new longs are being gifted a low entry point due to market mispricing.

Even though investing in a microcap stock is considered highly risky, this is a particular case. With a 50-year business history, three consecutive quarters of GAAP profitability and revenue growth, favorable macroeconomic conditions, world-leading technology, control, and ownership by Nistec, ELTK is at a real competitive advantage.

After doing months of due diligence, and completing my 5+% purchase of ELTK, I visited ELTK’s factory and toured all of the Nistec’s facilities. Unlike some activist investors, I fully support ELTK’s management team and look forward to working with Nistec owner Mr. Yitzhak Nissan, CEO Mr. Eli Yaffe, and CFO Alon Mualem in the Company’s evolution.

Eltek is an excellent company with the right tech in the right space at the right time.

Disclosure

I am long ELTK, and I own 5%+ of the Company as filed in schedule 13D with the SEC. Information presented in this article is my own opinion and is for informational purposes only; it does not intend to make an offer or solicitation for the sale or purchase of any securities, and should not be considered investment advice. Be sure to first consult with a qualified financial adviser and tax professional before implementing any strategy discussed here. The information provided reflects my views as of specific periods; such opinions are subject to change at any point without notice. I will not trade in ELTK during the next 72 hours.